The Year for Canceling Debts

The Year for Canceling Debts

Rosh Hashanah, the Jewish New Year, and means “head of the year or first of the year.” This day is the first day of Tishrei, the seventh month of the Hebrew calendar, which falls in Sept. - Oct. Rosh Hashanah 2021 to Oct 2022.

Deuteronomy 15 v 1 – At the end of every seven years you must cancel debts. 2 This is how it is to be done: Every creditor shall cancel any loan they have made to a fellow Israelite. They shall not require payment from anyone among their own people, because the Lord’s time for canceling debts has been proclaimed. 3 You may require payment from a foreigner, but you must cancel any debt your fellow Israelite owes you.

God took this land rest so seriously that He only allowed Israel to violate the command for 490 years then He came to collect on the 70 years of rest they owed the land. They were taken into captivity for 70 years to give the land an opportunity to rest.

2 Chronicles 36 v 19 – 22 So they burned down the house of God, tore down the wall of Jerusalem, burned down all the palaces with fire, and destroyed all the precious items. 20 Then he carried into exile to Babylon the remnant, who survived the sword, and they were slaves to him and his sons until the kingdom of Persia ruled, 21 to fulfill the word of the Lord by the mouth of Jeremiah until the land had enjoyed her Sabbaths. As long as she lay desolate, she kept Sabbath, to fulfill

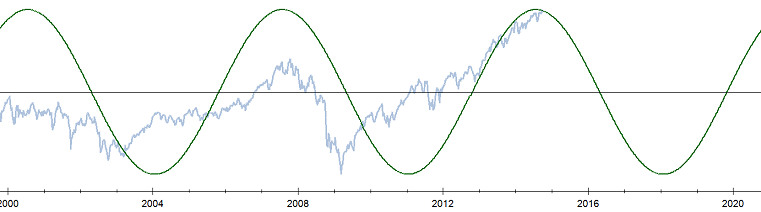

Cycles in stocks and the economy are not new. We talk about the Economic cycles. WD Gann was famous for his Dow Cycle theory.

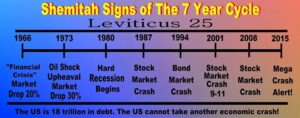

The year of “Shmita” or “Shemitah” (meaning: letting go) also called the sabbatical year occurs every seventh September or October. The story behind the Shemitah is that the 7th year is the year of resting and releasing. The year also stands for debt forgiveness to break debt cycles.

So what makes this Shemitah cycle so interesting? If we compare the Shemitah years with the financial markets we can see a correlation. Major crashes in the stock market are correlated with the Shemitah years. Here are examples of stock market crashes that occurred during Shemitah years,

- 1901-1902 Year of Shemitah - Stock market drops almost 50%.

- 1916-1917 Year of Shemitah - Stock market drops 40%. United States enters WWI. Germany, Russia, Austria, Turkey, Great Britain suffer economic collapse.

- 1930-1931 Year of Shemitah - The Great Depression. The worst financial crisis in modern history.

- 1937-1938 Year of Shemitah - Half of the stock market collapses sparking a global recession.

- 1944-1945 Year of Shemitah - End of German Reich and Britain's hold on territories. Establishment of America as the world's superpower. Bretton Woods Conference giving the U.S. Dollar Global Reserve Currency status

- 1965-1966 Year of Shemitah - Stock market drops almost 25%

- 1972-1973 Year of Shemitah - Stock market crashes almost 50%. Global recession; US oil crisis.

- 1979-1980 Year of Shemitah - Global recession - Prime Rate hits 21%

- 1986-1987 Year of Shemitah - “Black Tuesday”; stock market crashes by 1/3.

- 1993-1994 Year of Shemitah - Bond market crash.

- 2000-2001 Year of Shemitah - 9/11. Markets open on final day of Shemitah, September 17; the stock market falls 700 points.

- 2007-2008 Year of Shemitah - On the last day of The Shemitah Year, September 29, the stock market drops a record 777 points.

- 2014-2015 Year of Shemitah …correction…Greek/EU bailout....European Debt Crisis

- 2021-2022 Year of Shemitah …8th Jubilee for U.S.A – A world drowning in debt with a "bubble" economy.

What could this all mean?

The stock market has been inflated and on an artificial “bull run” for several years now. Trillions of dollars in Government debt handed out to spend and zero interest rates have inflated all assets. Asset values are due for a massive correction, and The Shemitah seems to be the time of debt forgiveness.

As a former stockbroker, I will not bore you with all the economic danger signals …..Each warning us that all Stock, Bond, and Real Estate assets are incredibly overvalued. U.S. public debt has doubled in 10 years, including by 14% in the last year alone while interest rates are kept artificially low. One-fifth (20%) of all US dollars were created in the year 2020. Inflation is rising and interest rates must rise.

• Real Estate Bubble is popping - 7% Mortgage Rates are not good.

• Retail Earnings miss heavily with a bad holiday season

• Industrial production drops sharply

• Used car bubble pops

• Mass consumer defaults on car loans

• Layoffs in tech spreads to all industries

• Credit spread blowout

• Zombie companies reduced to rubble

• Mass bankruptcies

• Negative real growth in all four macro sectors (income, production, consumption,

• Various crypto exchanges are insolvent

• Disinflation and then deflation (not stagflation)

• Energy bear market

• Corporate bonds turn into junk

• Municipal bond meltdown

Proverbs 27 v12 - Wise people see trouble coming and get out of its way, but fools go straight to the trouble and suffer for it.

Embrace God's priorities. Please reduce your debt - build up some savings - and create a network of friends among the Family of God. We will all soon be living by Faith and staking our survival on the Faithfulness of God our Provider. (Jehovah Jireh.)

The Breakdown was as follows:

The Breakdown was as follows: